401k withdrawal tax rate calculator

This 401k Early Withdrawal Calculator will help you compare the consequences of taking a lump-sum distribution from your 401k or even your IRA versus rolling it over to a tax-deferred account. 1 online tax filing solution for self-employed.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Withdrawing money from a qualified retirement plan such as a Traditional IRA 401k or 403b plans among others can create a sizable tax obligation.

. Americas 1 tax preparation provider. Calculate your total tax due using the tax calculator updated to include the 202223 tax brackets. Types of Retirement Plans.

How to Work 401k Pre-tax Dollars to Your Advantage. The 401k Calculator can estimate a 401k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment return. Buying a House With 401K.

55 or older If you left your employer in or after the year in which you turned 55 you are not subject to the 10 additional tax. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Gross 401K Withholding Gross IRA Deductions Withholdings.

This is another thing that the spreadsheet does not take into account. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. An average growth rate of a market portfolio grows by 7 annually.

Use our Retirement Savings Calculator. You pay capital gains tax on your gain at withdrawal. Federal Income Tax Rate.

The capital gains tax calculator uses these numbers to determine the correct amount of tax to pay. Discover your 401k Rollover Options. Balancing the withdrawal rate with the growth rate is part of the science of investing for income.

Once you reach age 59½ you can withdraw funds from your Traditional IRA without restrictions or penalties. This increase in the cost of things we purchase typically comes out to about 2 to 3 a year and it can significantly affect your retirement moneys purchasing power. Use this calculator to see what your net withdrawal would be after taxes and penalties are taken into account.

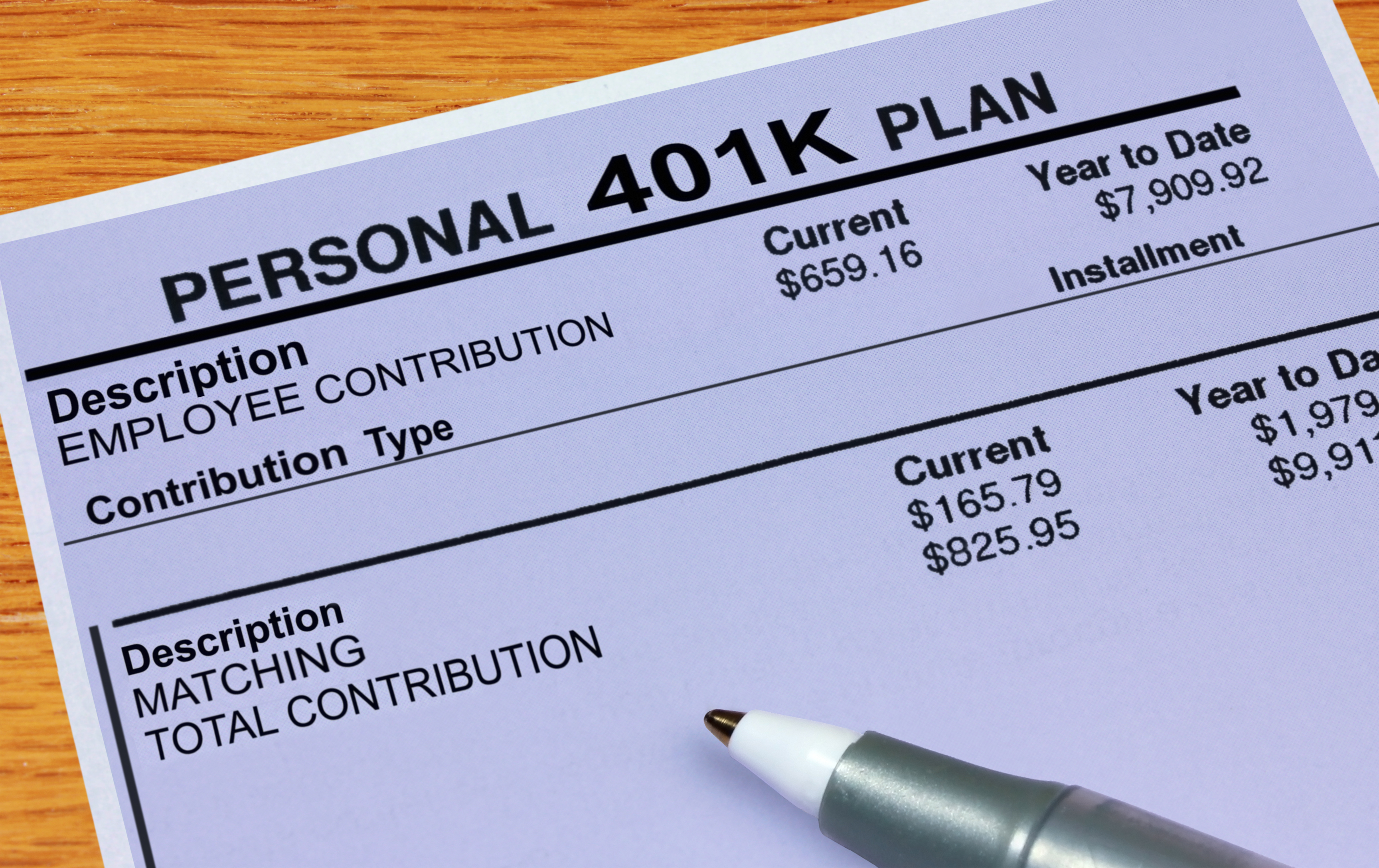

For example if you start contributing to a pre-tax 401k and put 5000 in the account through payroll contributions you wont have to pay income tax on that 5000 when tax season rolls around. Money withdrawn will be taxable and subject to a mandatory 20 federal withholding rate. What is the financial cost of taking a distribution from my 401k or IRA versus rolling it over into another tax deferred account.

And secondly the IRS considers all 401k withdrawals to be taxable income but an early withdrawal could incur a 10 early distribution tax on top of the standard income tax rate. For figuring your allowable contribution rate and tax deduction for your 401k plan contributions. If I deposit a certain amount in my 401k each month what will it grow to by any future point in time.

As an example lets say someone earns 50000 in normal taxable income for the year. Transferring tax advantages fees and more. See also Calculating Your Own Retirement Plan.

The 529 Plan Contributions allows tax deductions in certain states currently the Tax Form Calculator only applies this tax credit in Indiana please contact us if your State provides 529 Plan Contributions tax credits and we will integrate it into this tool. That is usually a pretty good assumption but if you want to take taxes into account you can use a tax-adjusted interest rate. Because you dont pay taxes on your contributions your withdrawals will be taxed at your ordinary income rate in retirement.

You may prefer to use the State Tax calculator which is updated to include the State tax tables and rates for 202223 tax year. Withdrawing the amount from 401k may lower the mortgage payments by around 1 but you also do not earn interest of around 7 on the money withdrawn in addition to the 10 withdrawal penalty. However future withdrawal amounts will largely depend on whether your investments meet your long-term growth assumption of 6.

401K and other retirement plans. You may also face early withdrawal penalties. You can make a penalty-free withdrawal at any time during this period but if you had contributed pre-tax dollars to your Traditional IRA remember that your deductible contributions and earnings including dividends interest and capital gains will be taxed as ordinary income.

State Income Tax Rate. You pay income tax on the entire amount of your withdrawal. For example if interest is taxed at the rate of 15 you can calculate a tax-adjusted interest rate as 1-rate15.

For one the money you take out will likely be subject to early withdrawal 401k fees imposed by your plan administrator. Based on your effective tax assumption of 15 your annual after-tax income is. Self-Employed defined as a return with a Schedule CC-EZ tax form.

The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. LocalCity Income Tax Rate. If you return the cash to your IRA within 3 years you will not owe the tax payment.

One Participant 401k Plans One-Participant 401k Plans More In Retirement Plans. 401k Early Withdrawal Calculator. You also need to take inflation into account.

State Income Tax Rate The percentage of taxes an individual has to pay on their income according to the laws of their state. Estimate your marginal state income tax rate your tax bracket based on your current earnings including the amount of the cash withdrawal from your retirement plan. But if you withdraw money from your 401k prior to age 59½ not only will you have to pay taxes youll also be hit with a 10 percent penalty.

For 2022 this would put a single filer in the 22 marginal tax bracket. If you are under 59 12 you may also be subject to a 10 early withdrawal penalty. How much tax will I pay on a 401K withdrawal.

Weve planned it such that your overall income over time will increase at rate of inflation of 2. 202223 Tax Refund Calculator. IRA and 401K Calculator.

The tax advantage of the 401k. 401k Plans in 2022. Were here to help Call 866-855-5635 Chat.

A pre-tax 401k is an incredible opportunity to put your hard-earned money to work. Capital Gains Tax Example. Individuals will have to pay income taxes on withdrawals though you can split the tax payment across up to 3 years.

Use the rate table or worksheets in Chapter 5 of IRS Publication 560. This first calculator shows how your balance grows during your working years.

How To Calculate Taxes Owed On Hardship Withdrawals 13 Steps

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Traditional Vs Roth Ira Calculator

Retirement Withdrawal Calculator For Excel

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Traditional Vs Roth Ira Calculator

How Much Is Your 401k Taxed After Retirement 2022

What Is The 401 K Tax Rate For Withdrawals Smartasset

401k Calculator Withdrawal Collection Cheapest 56 Off Aarav Co

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

401k Calculator

How To Calculate The Income Taxes On A 401 K Withdrawal Sapling

Free 401k Calculator For Excel Calculate Your 401k Savings

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Tax Withholding For Pensions And Social Security Sensible Money

Free 6 Sample Retirement Withdrawal Calculator Templates In Excel